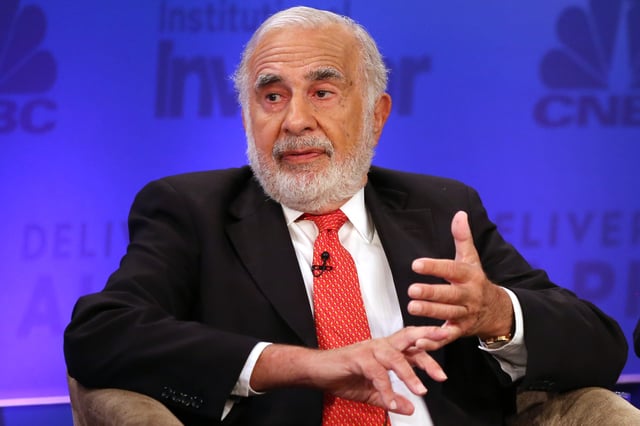

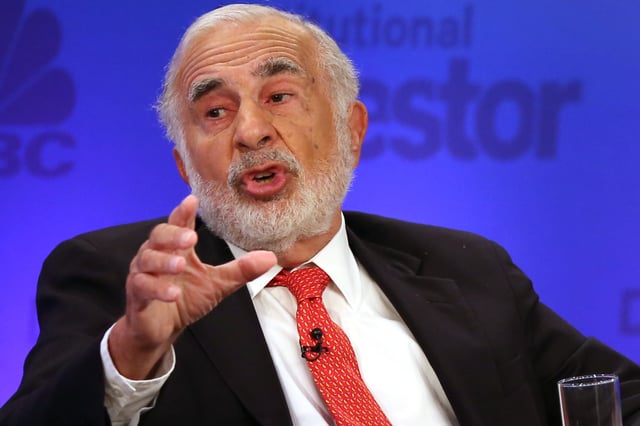

Overview

- Hindenburg Research accused Icahn Enterprises of inflating the value of its assets and relying on money from new investors to fund dividend payments to existing investors.

- Icahn Enterprises' stock price fell by 20% following the report, reducing Icahn's net worth by $10 billion.

- Hindenburg Research claimed Icahn Enterprises' assets were overvalued by 75% and its stock traded at a 218% premium relative to its net asset value.

- Icahn called the short-seller's report "self-serving" and aimed solely at generating profits from a short position in Icahn Enterprises stock.

- The sharp decline in Icahn's net worth dropped him from 58th to 119th on the Bloomberg Billionaires Index.