Overview

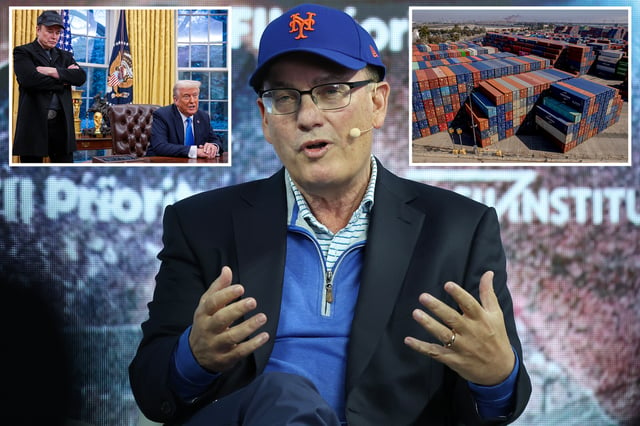

- Steve Cohen, founder of Point72 Asset Management, predicts slower U.S. economic growth and a potential market correction in 2025.

- He attributes his negative outlook to President Trump's tariff policies, which he describes as a tax likely to invite retaliatory measures from trading partners.

- Cohen also highlights reduced immigration as a factor constraining labor force growth and economic momentum.

- Elon Musk's Department of Government Efficiency, focused on cutting federal spending by $2 trillion, is described by Cohen as an austerity measure that could negatively impact the economy.

- Economic growth is projected to slow from 2.5% to 1.5% in the second half of the year, with Cohen emphasizing uncertainty and potential volatility in financial markets.