Overview

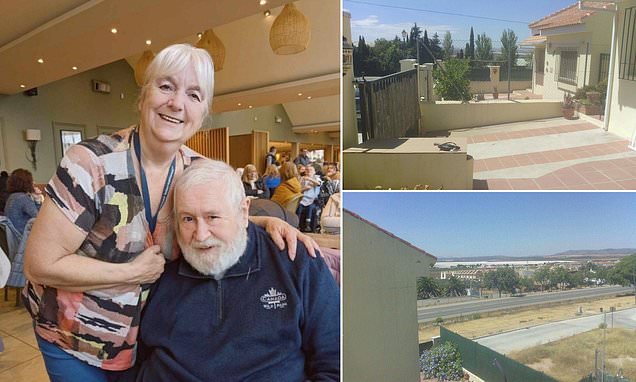

- The Browns, who lived in Andalusia from 2010 to 2017, were billed €11,143.57 for the 2016-17 tax years despite paying UK pension taxes under the UK-Spain double taxation treaty.

- The couple received no explanation for the tax demand, which was relayed to them by HMRC on May 2, 2025, eight years after they returned to the UK.

- A report by Amsterdam & Partners LLP exposes systemic misuse of Spain's Beckham Law, alleging false and retrospective tax claims targeting foreign nationals, including British expats.

- The Browns assert they followed all legal procedures, including deregistering from Spain's tax system and employing a bilingual specialist, and are formally disputing the debt.

- Experts warn that Hacienda may be disregarding the UK-Spain tax treaty, with affected expats facing years-long refund processes and substantial penalties.