Overview

- The Consumer Financial Protection Bureau (CFPB) has officially withdrawn a proposed rule to classify data brokers as consumer reporting agencies under the Fair Credit Reporting Act (FCRA).

- The rule, introduced under former CFPB Director Rohit Chopra in December 2024, aimed to require data brokers to obtain consumer consent before selling sensitive personal information.

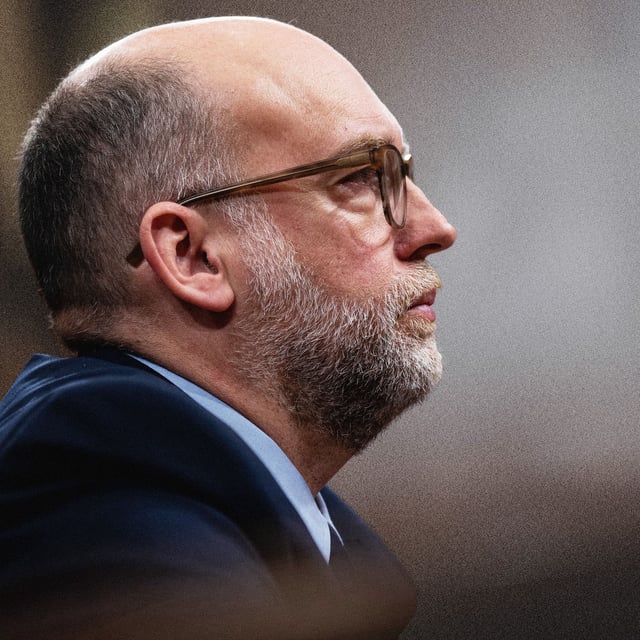

- Acting Director Russell Vought justified the withdrawal, stating the rule did not align with the agency’s revised interpretation of the FCRA and its current policy objectives.

- Privacy advocates warn that the rollback leaves consumers vulnerable to scams, identity theft, and national security threats, as data brokers operate largely unregulated.

- Industry lobbying, including from the Financial Technology Association, played a significant role in opposing the rule, arguing it exceeded legal authority and could hinder fraud prevention efforts.