Overview

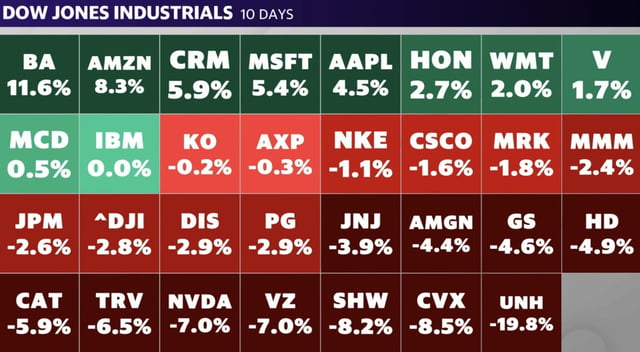

- The Dow Jones Industrial Average has fallen for 10 consecutive trading days, marking its longest losing streak in 50 years and a 6% decline over that period.

- Wednesday’s 1,123-point drop followed the Federal Reserve's scaled-back forecast for only two interest rate cuts in 2025, dampening hopes for quicker economic recovery.

- UnitedHealth Group’s stock, down nearly 20% this month after the fatal shooting of its CEO, and Nvidia’s recent declines have significantly dragged on the price-weighted index.

- Despite the Dow's slump, broader markets like the S&P 500 and Nasdaq remain relatively strong, with the Dow still up 14% for the year.

- Market analysts point to diverging sector performance, with tech-heavy indices benefiting from growth stocks while the Dow faces pressure from healthcare and select tech underperformers.