Overview

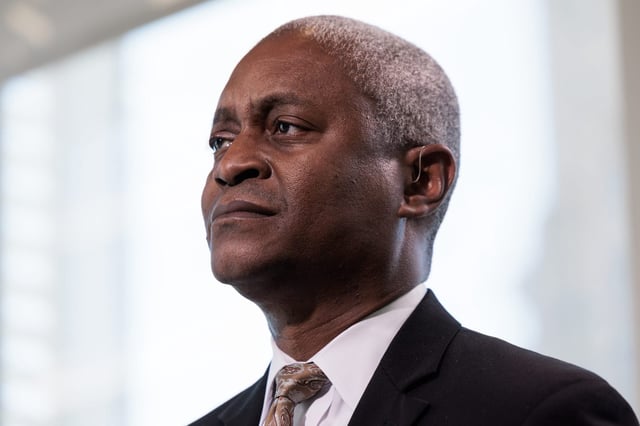

- Atlanta Fed President Raphael Bostic revised his forecast to support only one rate cut in 2025, diverging from the Fed's March projection of two cuts.

- New York Fed Chief John Williams and other officials highlighted the need to hold rates steady until at least September to better evaluate the effects of tariffs.

- Market futures reflect less than a 10% chance of a June rate cut, though investors still anticipate two reductions by year-end, underscoring a gap with Fed sentiment.

- Fed officials stress that recent tariffs have heightened economic uncertainty, raising concerns about inflationary pressures despite stable employment levels.

- Key upcoming data on inflation and employment in June will play a critical role in shaping the Fed's monetary policy decisions for the remainder of the year.