Overview

- FuboTV reported Q4 2024 revenue of $433.8 million, an 8% increase year-over-year, but fell short of analysts' expectations.

- The company ended the quarter with 1.67 million subscribers but forecasted a drop to 1.43–1.46 million subscribers in Q1 2025 due to a carriage dispute with TelevisaUnivision.

- Fubo's stock fell over 20% after the company provided lower-than-expected Q1 revenue guidance of $413 million and reported a 12% decline in Q4 advertising revenue.

- Fubo and Disney announced a planned merger of Fubo with Hulu + Live TV, expected to close by 2026, creating the second-largest streaming pay-TV provider in the U.S., with Disney holding a 70% stake.

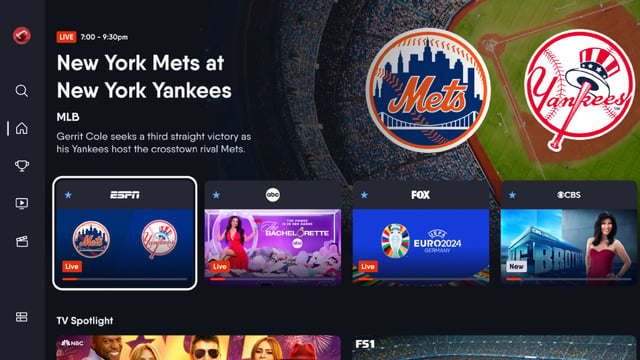

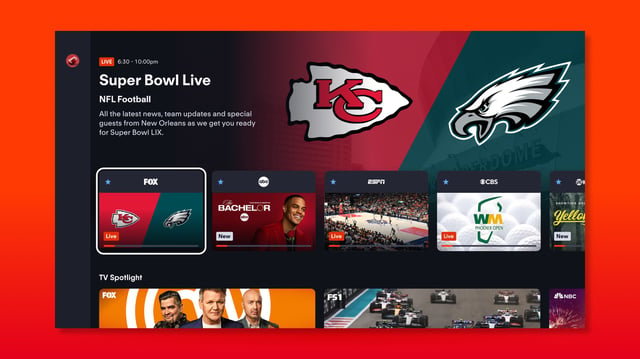

- Fubo plans to launch a new sports-focused streaming package in fall 2025, aiming to attract sports fans with a competitive alternative to traditional cable bundles.