Overview

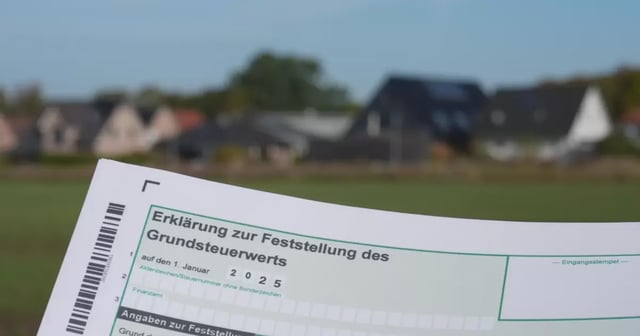

- The 2025 property tax reform, mandated to address outdated valuation methods, is causing widespread uncertainty as many municipalities have yet to issue updated tax assessments.

- Property owners are advised by the homeowners' association Haus & Grund to withhold payments if they have not received new tax notices, citing the old system's unconstitutionality.

- The reform aims for revenue neutrality overall, but uneven impacts are expected, with private homeowners potentially facing higher costs while some commercial properties may see reductions.

- Municipalities are struggling to finalize new tax rates, with some opting to increase rates significantly to maintain revenues, while others delay adjustments to avoid backlash.

- Critics highlight administrative challenges, a lack of transparency, and fears of legal disputes, as political debates continue over fairness and the reform's implementation.