Overview

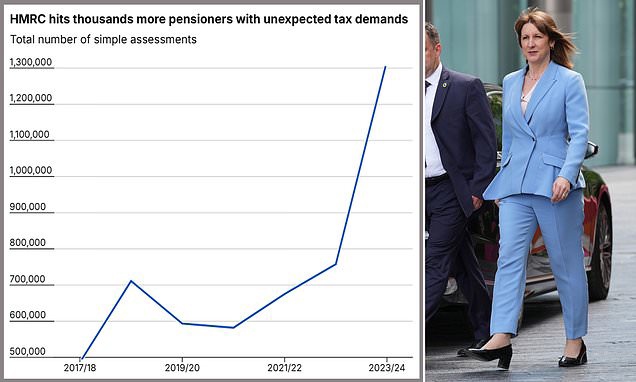

- HMRC issued 1.32 million simple assessments in 2023-24, a 74% increase from the previous year and the highest number on record.

- The rise is attributed to frozen income tax thresholds since 2021, which remain unchanged through 2028, and growing state pensions under the triple lock system.

- Simple assessments allow HMRC to collect taxes without requiring self-assessment returns but have caught pensioners unaware with unexpected tax bills.

- Experts warn that many retirees, assuming their income is below the £12,570 personal allowance, are unprepared for these demands, leading to stress and confusion.

- Calls are growing for a review of tax thresholds and assessment procedures to address the administrative and financial strain on pensioners.