Overview

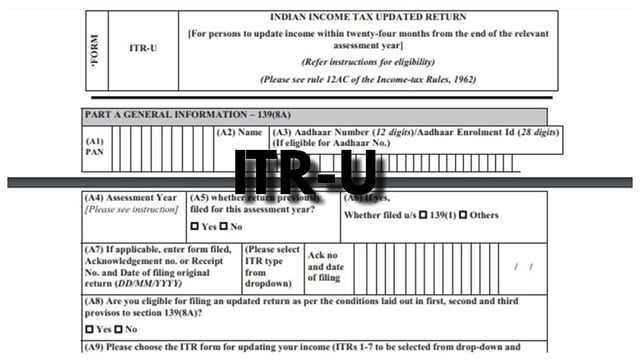

- The Income Tax Department has officially notified the updated ITR-U form, extending the filing window to 48 months from the end of the relevant assessment year, as per the Finance Act, 2025.

- Taxpayers filing updated returns will face a tiered penalty system: 25% additional tax within the first year, rising to 70% for filings in the fourth year.

- ITR-U facilitates voluntary compliance by allowing corrections to previously filed returns or submission of missed returns, addressing errors such as unreported income or incorrect tax credits.

- Section 148A notices restrict ITR-U filings after 36 months unless deemed invalid, in which case the 48-month window applies.

- Nearly 90 lakh ITR-U filings in the past three years have generated approximately Rs 8,500 crore in additional revenue, reflecting improved compliance efforts.