Overview

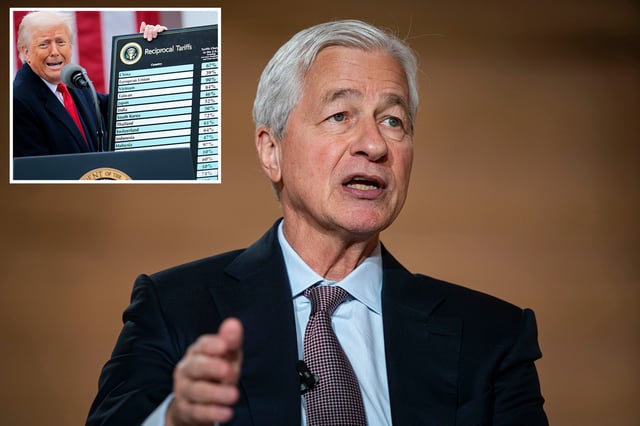

- Jamie Dimon cautioned that stagflation remains a possibility for the U.S. economy, citing inflationary pressures from global deficits, trade restructuring, and remilitarization.

- He supported the Federal Reserve's 'wait-and-see' strategy on interest rates, describing it as prudent given the economic uncertainties.

- Dimon noted that President Trump's new tax bill could stabilize the economy in the short term but warned it would exacerbate the federal deficit.

- Markets are underestimating risks from tariffs, deficits, and geopolitical tensions, according to Dimon, who criticized their 'extraordinary complacency.'

- While acknowledging recent economic stability, Dimon stressed the need for responsible fiscal measures to address long-term challenges, including the ballooning national debt.