Overview

- JPMorgan's chief global strategist, David Kelly, predicts a 'soft landing' for the US economy, with a 35% to 40% chance of a recession, down from a 100% prediction in late 2022.

- Kelly's economic thesis for 2024 includes 2% GDP growth, zero recessions, 2% inflation, and a 4% unemployment rate, which aligns with a healthy expansion.

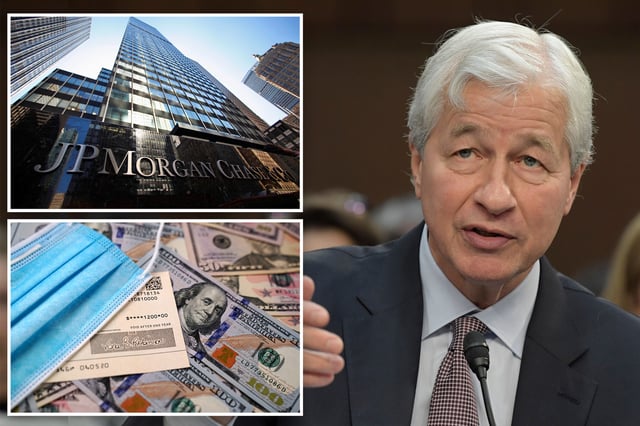

- JPMorgan CEO Jamie Dimon expresses skepticism about the 'Goldilocks' economy scenario, citing the end of COVID-related financial aid and a huge federal deficit.

- Dimon warns of potential disruptions from geopolitical tensions, such as conflicts in Ukraine and Israel, and the impact of the US elections.

- Despite differing views, both Kelly and Dimon agree that businesses need to be prepared to navigate potential economic downturns.