Overview

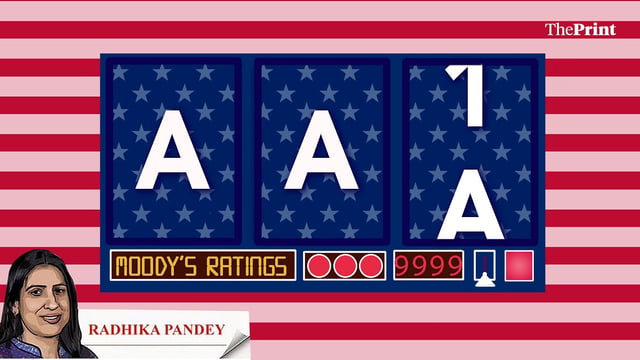

- Moody’s has downgraded the U.S. sovereign credit rating to Aa1, aligning with earlier actions by S&P in 2011 and Fitch in 2023.

- This marks the first time in over a century that the U.S. bond market lacks a top-tier Aaa rating, reflecting concerns over fiscal sustainability.

- 10-year and 30-year Treasury yields have risen to nearly 4.5% and 5%, respectively, signaling heightened investor caution.

- The downgrade stems from persistently high fiscal deficits, mounting debt, and political gridlock over tax and spending policies.

- Extraordinary measures by the Treasury to avoid a $36.1 trillion debt ceiling breach are expected to last until August 2025, as lawmakers negotiate potential reforms.