Overview

- The national average for 30-year fixed mortgage rates has risen to 6.84%, marking a steady increase over the past week.

- Refinance rates for 30-year fixed mortgages have reached 6.98%, up from a recent low of 6.71%, reflecting broader economic trends.

- Significant state-level disparities in mortgage rates persist, with lower averages in states like Florida and Texas (6.78%-6.81%) and higher rates in Alaska and Washington, D.C. (6.90%-6.94%).

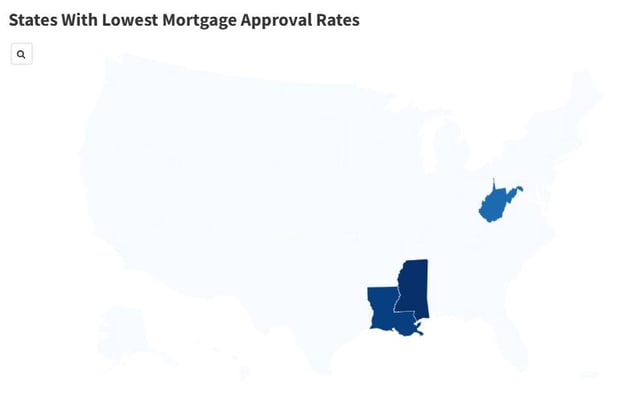

- Mississippi, Louisiana, and West Virginia report the highest mortgage denial rates, driven by economic challenges such as low income levels and limited credit access.

- Federal Reserve policies, including recent rate cuts and a decision to hold rates steady in early 2025, continue to influence mortgage trends and market uncertainty.