Overview

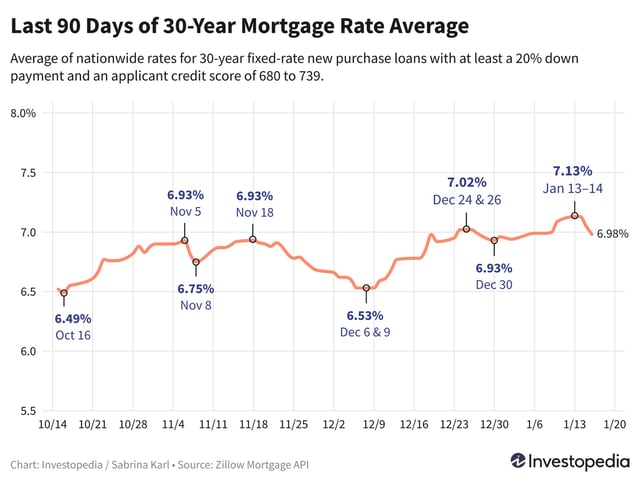

- The national average for 30-year fixed-rate mortgages has dropped to 6.98%, marking a two-day decrease of 15 basis points after reaching a seven-month high earlier this week.

- Refinance rates for 30-year fixed loans have also fallen for three consecutive days, now averaging 7.15%, down from 7.30% on Monday.

- Rates for other mortgage types, including 15-year fixed and jumbo loans, have also declined, with 15-year refinance rates now at 6.01%.

- The Federal Reserve's recent rate cuts and scaled-back projections for future reductions have influenced bond yields, indirectly impacting mortgage rates.

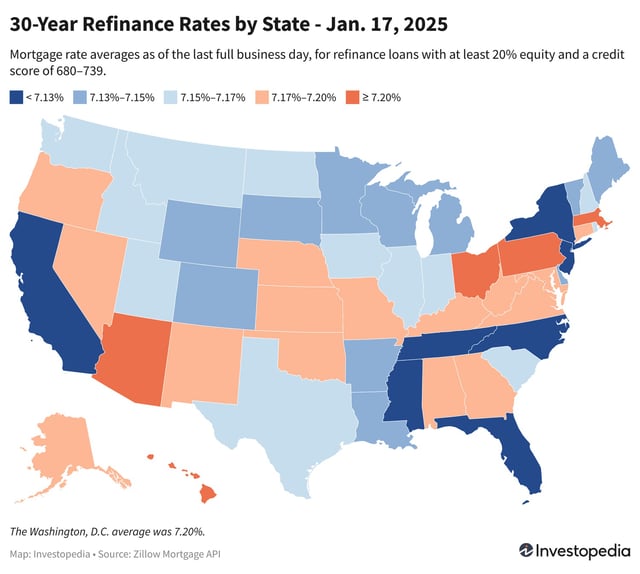

- Borrowers are advised to compare lender rates, as state-level variations and individual qualifications heavily influence final mortgage offers.