Overview

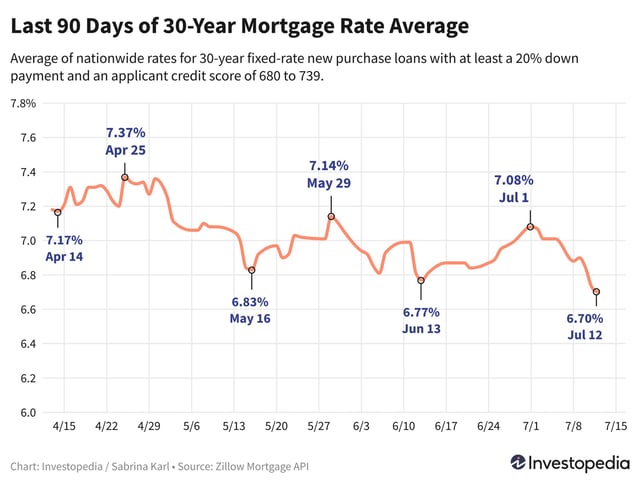

- Average 30-year fixed mortgage rates drop below 7% for both purchase and refinance options.

- 15-year fixed mortgage rates also see a significant decrease, improving affordability for buyers.

- Experts predict continued easing of mortgage rates throughout 2024 if inflation remains under control.

- Federal Reserve maintains a cautious stance on rate cuts, with the next policy meeting scheduled for late July.

- Increased housing inventory and price cuts provide additional opportunities for prospective buyers.