Overview

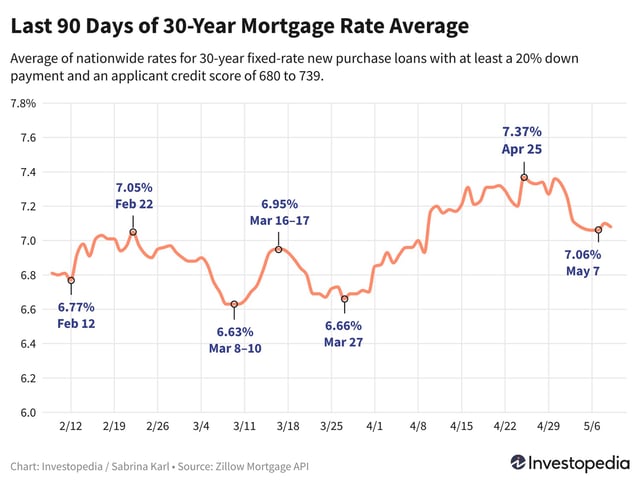

- Freddie Mac reports a notable drop in 30-year and 15-year fixed mortgage rates, marking the first decrease since early spring.

- Economic indicators such as a weaker-than-expected jobs report and inflation data are closely watched by lenders, affecting rate adjustments.

- Investors anticipate potential Federal Reserve rate cuts later this year, which could further influence mortgage rate trends.

- Refinance rates have also seen reductions, providing opportunities for homeowners to secure better terms.

- The housing market remains tight with high prices, though upcoming Federal Reserve decisions and economic reports could shift dynamics.