Overview

- Mortgage rates for 15- and 30-year terms have decreased, with the 30-year fixed-rate mortgage now at 6.490% and the 15-year fixed-rate at 5.625%.

- Investors anticipate the Federal Reserve may start reducing rates by May or June, potentially easing mortgage rates during the homebuying season.

- Mortgage rates are influenced by various factors including the Federal Reserve's policies, inflation, and economic conditions.

- Comparing lenders and loan offers is crucial for borrowers to secure the best mortgage rates and terms.

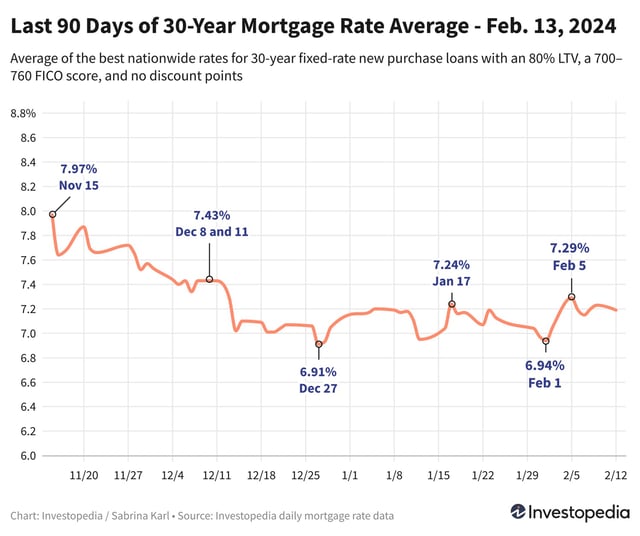

- Mortgage rates are expected to trend downwards in the coming months as inflation decreases and the Federal Reserve potentially cuts the federal funds rate.