Overview

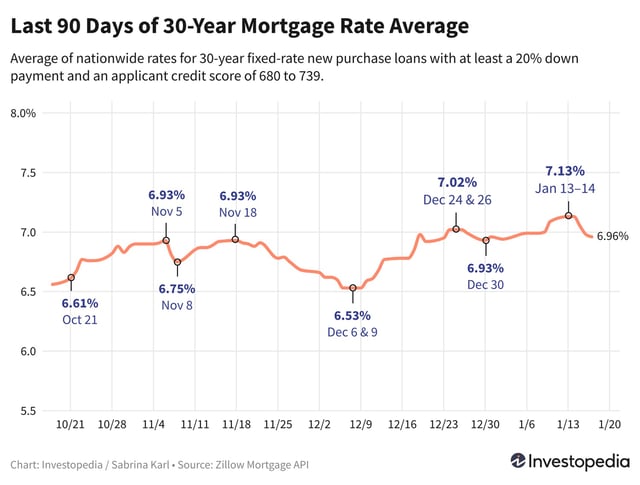

- The average rate for a 30-year fixed mortgage fell to 6.96%, marking a 13 basis point drop from the previous week.

- Other mortgage types, including 15-year fixed and jumbo 30-year loans, also saw rate reductions, with 15-year loans declining by 16 basis points to 6.06%.

- Despite the recent declines, rates remain significantly higher than the sub-6% levels seen in September 2024, contributing to ongoing affordability challenges for buyers.

- Economists predict that mortgage rates are unlikely to fall below 6% until 2026, citing persistent inflationary pressures and elevated Treasury yields.

- Elevated home prices and a historically high mortgage premium continue to exacerbate affordability issues for prospective buyers, limiting market activity.