Overview

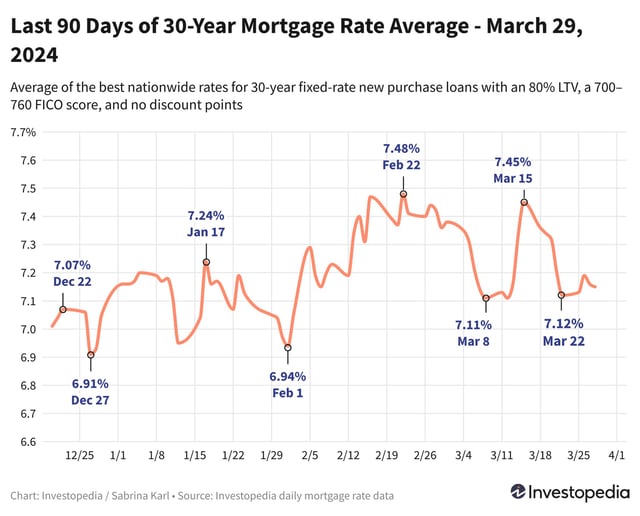

- Average 30-year mortgage rates have dropped nearly 30 basis points from a week ago.

- Investors expect a Federal Reserve rate cut in June, potentially leading to further decreases in mortgage rates.

- The 7/1 and 5/1 adjustable mortgage rates saw significant drops of 0.60% and 0.49%, respectively.

- Despite the overall decline, 30-year fixed refinance rates increased by 0.69%, highlighting a mixed mortgage rate environment.

- Economists predict mortgage rates may gradually decline by the end of 2024 as inflation eases.