Overview

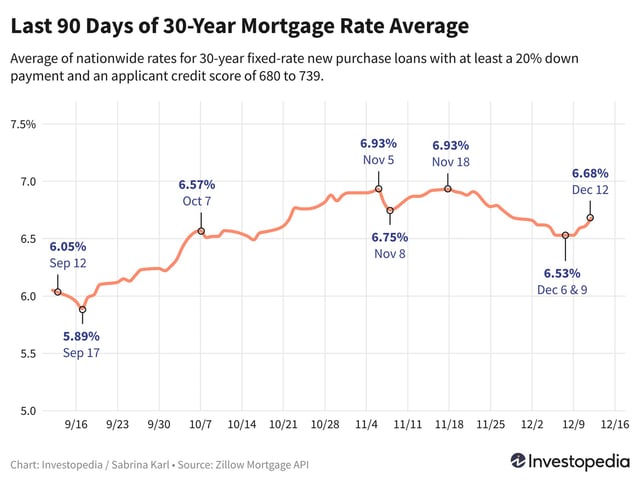

- Most 2025 forecasts predict 30-year mortgage rates will remain between 6% and 6.8%, similar to current levels.

- The Federal Reserve's recent rate cuts have not yet significantly reduced mortgage rates, which remain influenced by inflation and Treasury yields.

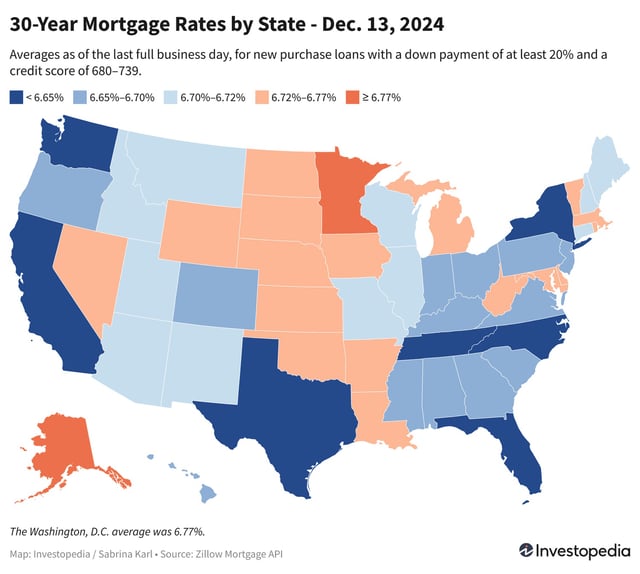

- State-level variations show the lowest average 30-year rates in New York and California at approximately 6.51%, while states like Alaska and Nebraska see rates as high as 6.81%.

- Economic policies under President-elect Trump, including proposed tax cuts and tariffs, could push rates higher if they increase inflation and the national deficit.

- While home affordability remains a challenge due to rising prices and stagnant incomes, economists note a modest increase in housing supply and slower price growth may benefit some buyers.