Overview

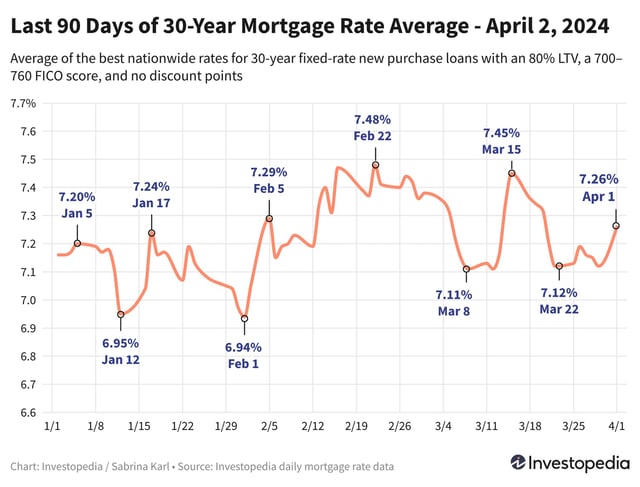

- Mortgage rates for 15- and 30-year fixed loans have increased, with the 30-year rate at 7.125% and the 15-year rate at 6.125% as of April 2, 2024.

- Rates fluctuate daily and are influenced by economic conditions, personal factors, and the Federal Reserve's policies.

- Economists expect rates to ease down in 2024, potentially offering relief to homebuyers.

- The Federal Reserve held its benchmark interest rate steady, signaling possible rate cuts later in the year.

- A settlement in the real estate industry could change homebuying by allowing consumers to negotiate broker commissions.