Overview

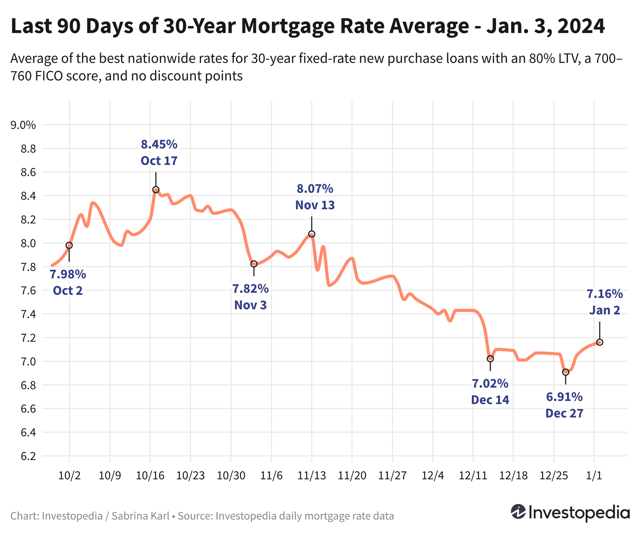

- Mortgage rates have increased for a third consecutive day, with the average rate for a 30-year new purchase mortgage reaching 7.16%, the highest level in almost three weeks.

- Despite the recent drop in interest rates, mortgage demand fell by 9.4% in the final week of 2023.

- The Federal Reserve has held rates steady at its last three meetings, with the possibility of rate cuts by the end of 2024.

- The housing market continues to struggle with high prices and low supply, despite recent optimism due to falling rates.

- Private residential construction increased to nearly $900 billion in November, a rise of more than a percent from the previous month.