Overview

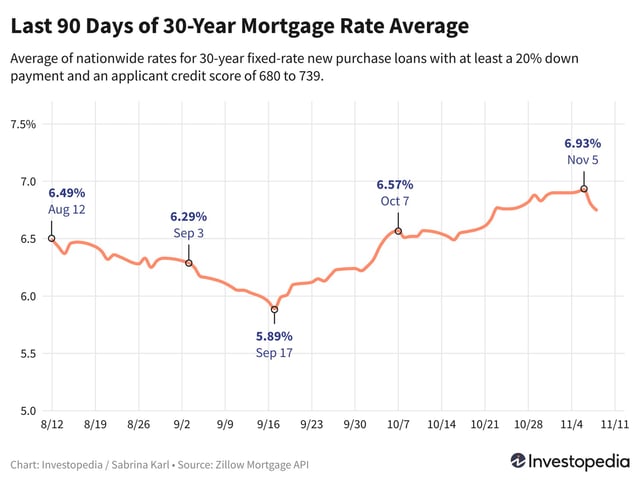

- The 30-year fixed-rate mortgage remains steady at 6.88%, while the 15-year term increased to 6.25%, indicating variable trends in the mortgage market.

- Economic indicators led to a Federal Reserve rate cut on November 7, reducing the federal funds rate to a range of 4.50% to 4.75%, with potential for further cuts if inflation continues to ease.

- Despite a recent drop, mortgage rates have returned to previous highs, making renting a more viable option for many potential homeowners.

- The cost of homeownership, including high mortgage rates and home prices, prompts many to reconsider buying versus renting in the current market.

- Experts suggest that while mortgage rates may eventually decrease, short-term increases could persist, influencing the timing of home purchases.