Overview

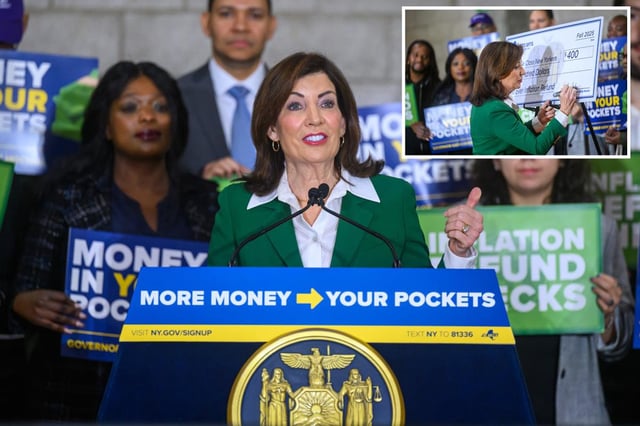

- The FY 2026 budget allocates $2 billion for inflation refund checks to over 8.2 million New Yorkers to address rising living costs.

- Checks will be automatically mailed between October and November 2025, with no application required for eligible recipients.

- Refund amounts are tiered based on income: single filers earning $75,000 or less will receive $200, while joint filers earning up to $150,000 will get $400.

- Eligibility requires filing a 2023 New York State income tax return, meeting income thresholds, and not being claimed as a dependent.

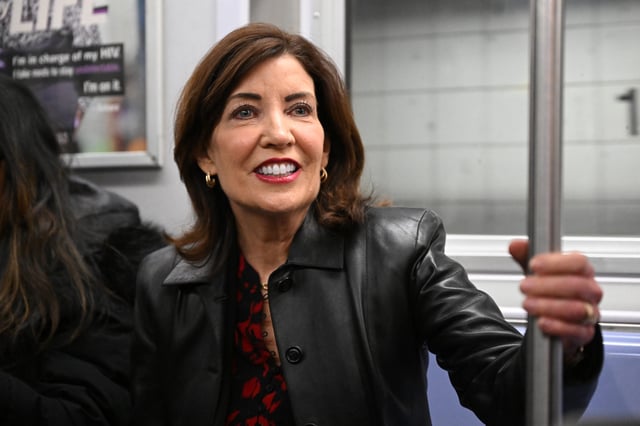

- The initiative is funded by increased sales tax revenue resulting from inflation and complements Gov. Hochul’s broader affordability measures, including tax cuts and expanded child benefits.