Overview

- Nvidia's stock price fell over 2% on Monday after an analyst reduced its two-year price target from $195 to $170, citing regulatory and geopolitical uncertainties.

- Despite the short-term challenges, analysts continue to view Nvidia as a leader in the AI market, with significant growth potential in AI infrastructure and applications.

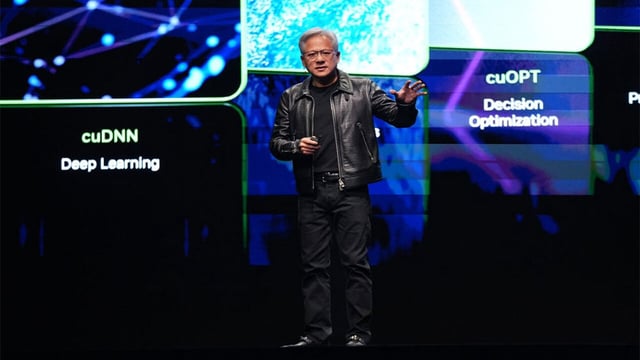

- The company is expected to unveil updates on its Blackwell architecture and potentially preview new GPUs and CPUs at its GTC conference next week, though these announcements remain speculative.

- Nvidia's valuation has dropped to its lowest relative to forward earnings in over a year, sparking discussions among investors about whether the stock is now undervalued.

- Nvidia's dominance in the AI chip market, bolstered by its CUDA platform and high demand for GPUs, positions it strongly as AI adoption accelerates globally.