Overview

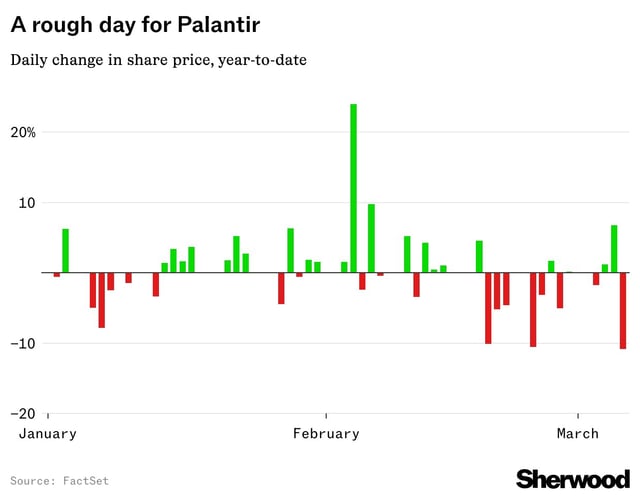

- Palantir shares fell 11% on Thursday, marking the worst performance in the S&P 500 and contributing to a broader tech sell-off that pushed the Nasdaq into correction territory.

- CEO Alex Karp has sold $45 million in stock in the past two weeks and $2 billion in 2024, reducing his stake by 21%, with other key executives also offloading significant holdings.

- The U.S. Department of Defense is reportedly planning an 8% annual budget reduction over the next five years, posing a major risk to Palantir, which heavily relies on government contracts for revenue.

- Palantir's stock has dropped more than 35% since its February 18 high of $125.41, with retail investors losing confidence as insider sales and external pressures mount.

- The company's reliance on its top three customers, which accounted for 17% of its 2024 revenue, and slower workforce growth have raised additional concerns about its long-term growth prospects.