Overview

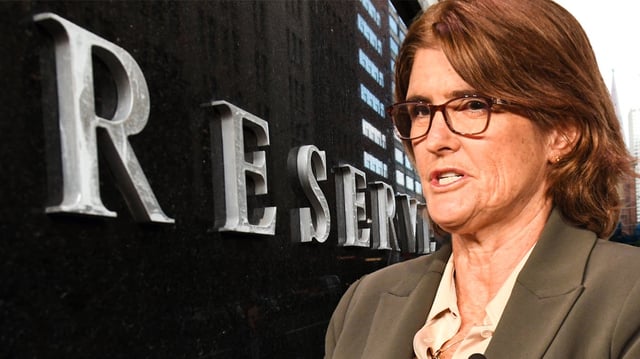

- The Reserve Bank of Australia (RBA) is expected to lower its cash rate from 4.10% to 3.85% during its May 20 policy meeting, according to a Reuters poll of economists.

- Core inflation cooled to 2.9% in the March quarter, falling within the RBA's target range of 2–3%, providing justification for a rate cut.

- The unemployment rate remains steady at 4.1%, aligning with forecasts and reinforcing the case for monetary easing.

- Economists anticipate two additional 25-basis-point cuts later in the year, potentially bringing the cash rate to 3.35% by December.

- Global trade uncertainties, including a recent US-China trade truce, and subdued domestic growth are cited as additional factors supporting the need for rate cuts.