Overview

- Shein’s proposed London IPO lost momentum after the China Securities Regulatory Commission failed to grant approval, despite earlier clearance by Britain’s Financial Conduct Authority.

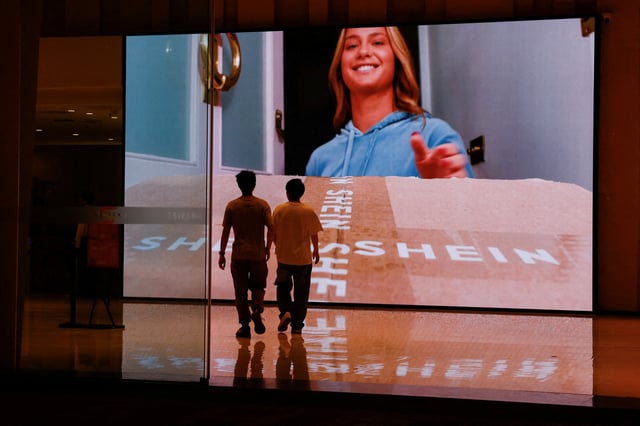

- The fast-fashion retailer will submit a draft prospectus to the Hong Kong stock exchange within weeks and is targeting a public debut there by year-end.

- U.S. tariff reforms ending the 'de minimis' exemption and pending EU parcel duty changes have eroded Shein’s ultra-low-price model, intensifying pressure on its IPO valuation.

- European regulators have issued warnings over consumer protection breaches and NGOs are mounting legal challenges over alleged forced labor in Shein’s Xinjiang-linked supply chains.

- Private fundraisings in 2023 valued Shein at $66 billion but recent profit declines have prompted investors to consider a corrected valuation near $50 billion for its upcoming flotation.