Overview

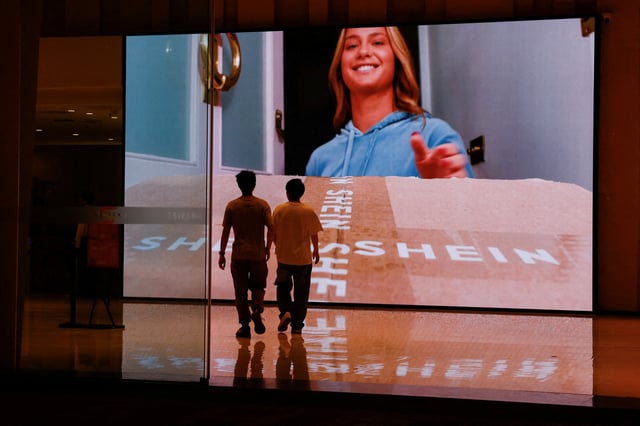

- Shein secured Britain’s FCA approval for a London IPO in March but has not received sign-off from the China Securities Regulatory Commission, stalling its U.K. debut.

- The company plans to file a draft prospectus with Hong Kong Exchanges within weeks and aims to list there before the close of 2025.

- Earlier attempts to float in New York were halted by U.S. regulatory concerns, while the London bid was disrupted by unexpected CSRC delays.

- Allegations that Shein’s products contain Xinjiang cotton and a potential legal challenge over forced labour have intensified scrutiny of its supply chain.

- The removal of U.S. and EU low-value duty exemptions and new tariffs on Chinese imports could pressure Shein’s IPO valuation regardless of venue.