Overview

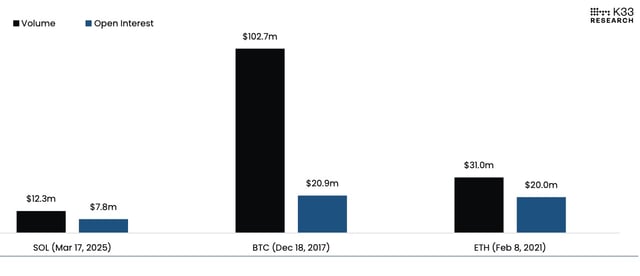

- Solana futures debuted on the Chicago Mercantile Exchange with $12.3 million in first-day trading volume and $7.8 million in open interest.

- These figures are significantly lower than Bitcoin and Ethereum's CME launches, which recorded $102.7 million and $31 million in first-day volumes, respectively.

- Analysts attribute the subdued performance to bearish market conditions and Solana's smaller market capitalization compared to Bitcoin and Ethereum at their launches.

- Solana's price declined 10% during the launch period, underperforming Bitcoin and Ethereum, which saw smaller declines of 4.5% and 3.8%.

- Despite the lackluster start, the launch is seen as a potential step toward expanded institutional access and the development of Solana-based ETFs.