Overview

- Tesla shares rose 2% on Monday after Morgan Stanley reiterated a $430 price target, citing the company's shift toward AI and robotics as key growth drivers.

- The stock has fallen nearly 28% in 2025, losing over $350 billion in market value, partly due to declining EV sales and CEO Elon Musk's political role under President Trump.

- Analysts predict Tesla's 2025 vehicle deliveries may decline year-over-year, but view this as an opportunity for investors to capitalize on the company's broader AI ambitions.

- Upcoming speculative initiatives, such as a lower-priced EV and a driverless taxi service, are highlighted as potential near-term catalysts for growth.

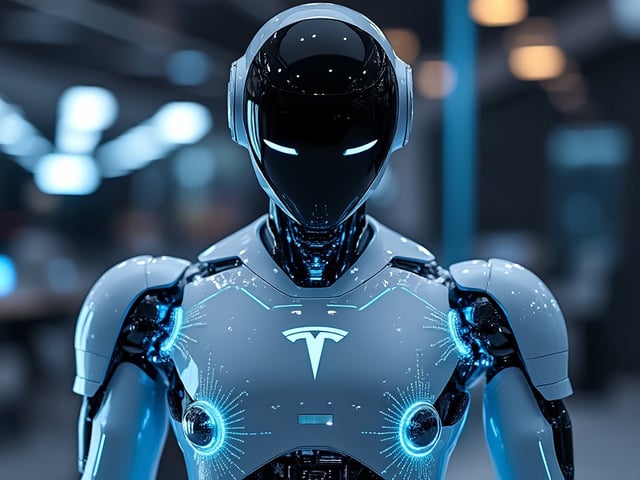

- Tesla’s Optimus humanoid robot and self-driving technology are seen as transformative, with analysts estimating significant valuation upside if these ventures succeed.