Overview

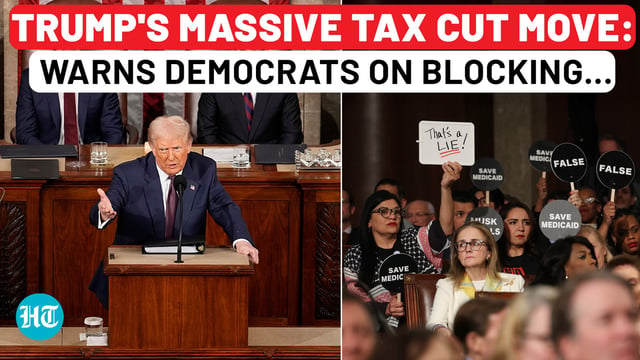

- President Trump proposed eliminating federal taxes on tips, overtime pay, and Social Security benefits during his address to Congress on March 5, 2025.

- The tax cuts are part of a broader agenda to provide financial relief to workers and retirees, with Trump emphasizing their importance for incentivizing extra work and supporting low-income earners.

- Economic analysts estimate the proposed changes could reduce government revenue by up to $5 trillion over the next decade, raising concerns about fiscal sustainability.

- Critics warn that exempting tips and overtime pay from taxes could lead to wage restructuring, potential tax loopholes, and limited benefits for non-tipped or lower-income workers.

- The proposals currently lack specific policy language and face uncertain legislative prospects, with debates ongoing about their economic impact and fairness.