Overview

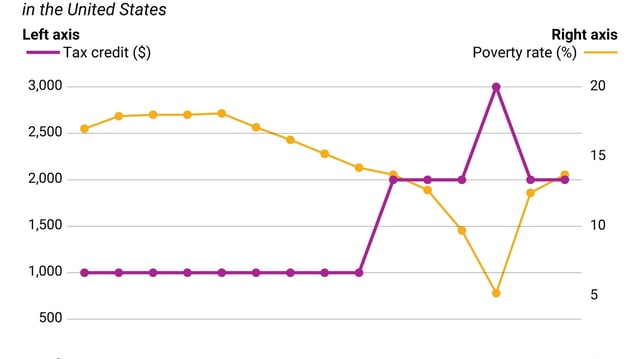

- The bill proposes raising the child tax credit to $2,500 per child through 2028 and creating $1,000 federally seeded MAGA savings accounts for children born between 2024 and 2028.

- It increases standard deductions for individuals, heads of households, and married couples, with an additional $4,000 deduction for seniors aged 65 and older.

- The legislation accelerates the expiration of clean energy tax credits, ending them in 2025 instead of their previously scheduled phase-outs.

- Democrats oppose the bill, citing cuts to Medicaid, food stamps, and renewable energy programs, while some Republicans demand deeper Medicaid cuts and higher SALT caps.

- The bill passed a key committee on May 18 but faces challenges in securing enough votes for passage in the House later this week.