Overview

- Private equity firms are targeting North America with $400 billion set aside for property investment.

- US office values fell by nearly a quarter last year, surpassing declines in Europe.

- Regional banks in the US are particularly vulnerable to real estate exposure, with more failures expected.

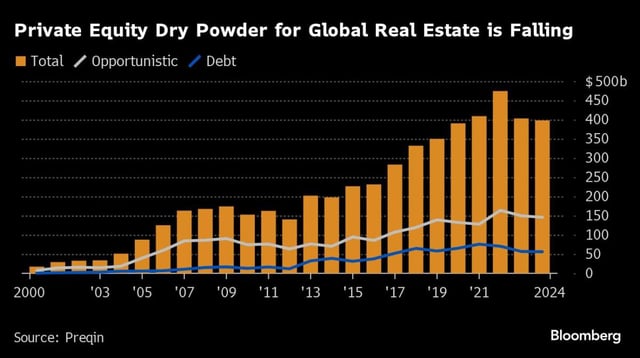

- Global private equity capital for real estate has shrunk by 26% since 2021, limiting buyer interest in distressed assets.

- European real estate markets may suffer from delayed recovery due to less frequent property valuations and low demand.