Overview

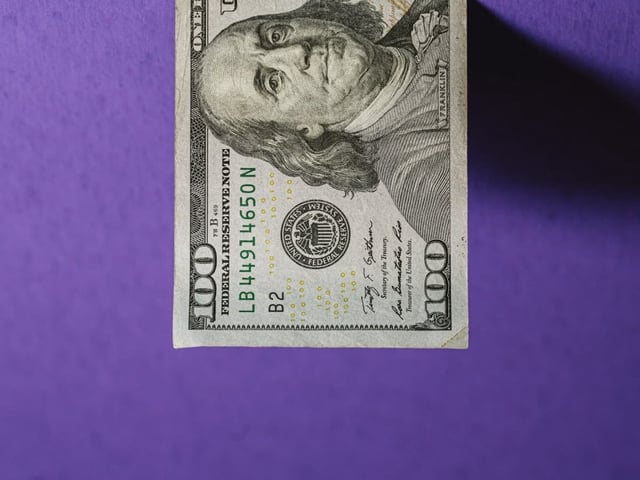

- The US dollar index has dropped to its lowest level in three years, losing over 4% since early April, driven by tariff-induced policy uncertainty.

- The euro has gained more than 10% against the dollar in 2025, reflecting a flight from US assets and growing confidence in the eurozone economy.

- The Russian rouble has strengthened 38% against the dollar this year, becoming the top-performing global currency due to high interest rates and capital controls.

- Global investors are reallocating capital from US assets to alternative currencies like the euro and rouble, citing concerns over US economic stability.

- Economic analysts warn that Trump's inconsistent trade policies could push the US into a recession, exacerbating long-term growth challenges.