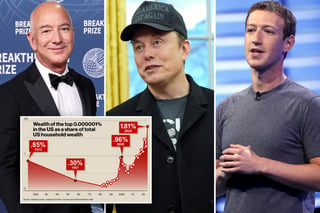

Billionaires Income Inequality Billionaires Wealth Economic Inequality Global Economy Wealth Wealth Inequality Wealth Inequality Reproductive Rights

Groundbreaking research ties high-income consumption and investments to climate extremes, intensifying calls for targeted wealth and carbon taxes.